The following exchange took place at a recent hearing of the US Senate Finance Committee.

Mr Warner (D): I wanted to ask as well, I know Senator Wyden raised the question of the European Union state aid cases and the overall impact because of potential targetting of American companies and what that impact is for American taxpayers.

Mr. Stack could you kind of walk through that just of terms if a taxpayer was sitting in front of you, how does it affect me ultimately or how could it potentially affect that taxpayer.

Mr Stack: Sure Senator. When a US company pays a tax in a foreign jurisdiction and then they bring money home they get a credit for the tax paid in a foreign jurisdiction up to a certain limit.

Now, in the normal case that means you are actually doing some business in Germany, let's say, and you had some tax and you brought it home and you got your credit. In this fact pattern, the EU is coming along and they're saying "Oh we think when you cut your deal with Ireland or Luxembourg or the Netherlands that in fact you, the company, should have been paying more tax to those jurisdictions."

Now if we were to determine that those payments are in fact taxes and we were to determine that they are creditable under our rules, now when that money comes home from those companies in addition to the credit they got for the tax they originally paid in those jurisdictions they get an extra credit. And that credit to this taxpayer you asked me about means in effect the US Treasury got less money and in effect made a direct transfer to the European jurisdiction that is getting the ruling from the Commission.

So if these turn out to be creditable taxes it is the US taxpayer that are footing the bill for these EU investigations.

The reply was given by Robert Stack, Assistant US Treasury Secretary with responsibility for international tax affairs and can be viewed beginning from timestamp 1:17:20 in the video on this page.

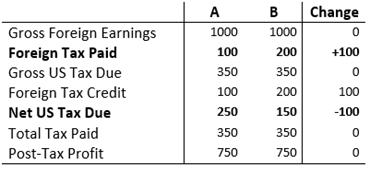

Here is a very very simplified set up of what Robert Stack is describing.

In both scenarios the company has foreign earnings outside the US of 1000. In scenario ‘A’ it pays foreign tax of 100 on those earnings, while in scenario B the foreign tax is 200.

In both cases the gross US tax due is the same (35 per cent of foreign earnings) but to avoid double taxation companies get a tax credit for foreign corporate income tax. If a US company pays more corporation tax abroad it gets a larger tax credit to offset its US tax liability.

This means that the net tax due to the US falls from 250 to 150 – there is less tax due in the US by an amount equivalent to the extra foreign tax paid. The total amount of tax remains the same and the company’s post-tax profit is unchanged. The increased foreign tax paid results in less US tax being due.

Of course, this is highly highly simplified and excludes one key complication – the ability of US companies to defer the US tax due on their foreign earnings – but the impact on the tax that could be paid to the US is the same. More foreign tax paid means less tax due to the US even if it is deferred.

Naturally, this was always known but as the EU state aid investigations have progressed the US has become ever more vocal on this issue. Maybe they felt they did not want to interfere with matters in other jurisdictions but it’s also likely that they felt the EU would not interfere with international agreements to allocate the taxing rights to corporate earnings.

Here’s Robert Stack later in the same hearing on this:

Mr Stack: We were faced with a choice as to whether speak up now before multi-billion dollar judgements are rendered against our companies or wait until the decisions have been handed down so we have been raising this issue today.

From my personal observation of these cases and study it appears to me that the Commission is attempting to tax income that really under international standards doesn't belong to any member and, I agree with you, my perception is that they are tring to tax the income that they perceive as untaxed because it has been deferred for US tax and they see it as something that is there for the taking because our system has let it set offshore without being taxed. So that's my perception of the substantive state of those cases. They have ways to go; I could be wrong. But that's the way I see them today.

So all those suggesting that Apple should pay more tax in Ireland (with some saying we should just force them!) need to back that up with reasons why the US Treasury and US taxpayers should foot the bill. And it needs to be more than “but the US doesn’t collect the tax”. That is true but the US has the right to tax that income – on what basis can we take that right from them?

Tweet