Last week the CSO published the end-year figures for the important International Investment Position and External Debt series. At a headline level Ireland’s net external debt (excluding the IFSC) fell to zero at the end of 2015.

Net external debt is the balance between gross external debt and external assets in debt instruments. So while our gross external debt might still be north of €500 billion there is €500 billion owing in debt intruments to Irish residents.

It is important to look at who has done the borrowing and who is doing the lending and there’s always a lot going on under the surface with Irish macro data.

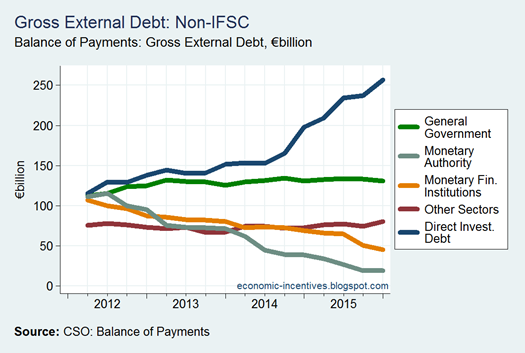

First a sectoral breakdown of our gross external debt.

We see that the external debt on the monetary authority (the Central Bank) has fallen significantly with the exterbal debt of our monetary financial instituitions (mainly the banks) also falling. The external debt of the government sector has remained fairly constant since this new data series began in 2012 while the external debt associated with direct investment has increased by almost €100 billion in the last 12 months. This increase is masking the reduction in our “underlying” gross external debt.

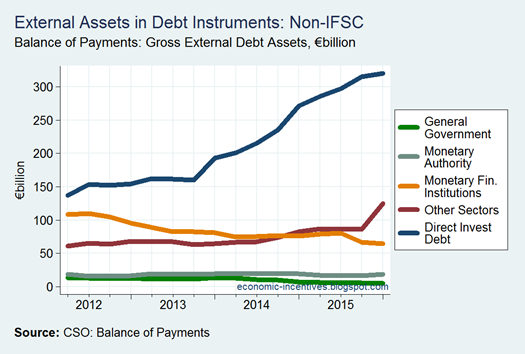

If we turning to our external assets in debt instruments we see a similar increase for the direct investment sector but this time it will make our net external debt to be falling more rapidily that it otherwise might be.

It is not clear what happened with the other sectors category which showed a near €40 billion increase in long-term debt instrument assets in Q4. This is attributed to an increase in “other debt instrument assets” rather than loans or bonds and notes. This category had almost always been below €5 billion since the start of 2012 but jumped to over €40 billion in Q4 2015.

According to the CSO “other sectors includes financial corporations other than the Monetary Authority and Monetary Financial Institutions, non-financial service and manufacturing companies and other industrial enterprises as well as (implicitly) households.” NFCs look like a likely candidate and the CSO provide total foreign assets and liabilities for the NFC sector.

What is immediately noticeable is the huge increase in the figures in just four years with foreign liabilities going from €350 billion in 2012 to nearly €900 billion by the end of 2015. Soon the NFC sector will have figures as large as the IFSC sector! But it can be seen that the gap between the two is relatively constant so the overall net figure is fairly stable.

But changes between sub-categories can give jumps like the increase shown for external assets in debt instruments in the previous chart. It seems that there was a big increase in the debt instruments assets of Irish residents NFCs (or maybe just one) in Q4 2015 but that this in turn is owed on again to a non-resident through a non-debt financial instrument.

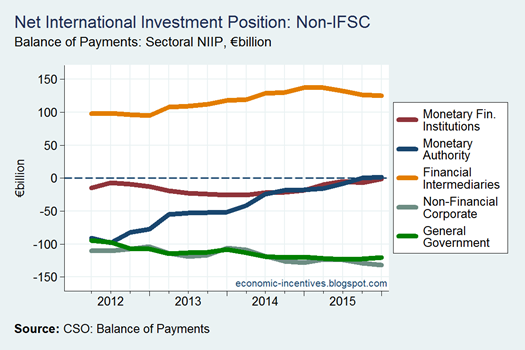

Anyway if we go back to our debt positions and look at the net external debt by sector we see the following.

The non-IFSC financial sector has eliminated its external debt position [the €100 billion net debt that the Central Bank shows here for 2012 would originall have been borrowed by the banks]. The external debt of the government sector remains an obvious issue.

But we’d like to know what our underlying external debt positions are. Given what we seen above it might be best to strip out debts associsated with direct investment and also with other sectors (though that only really affects Q4 2015 with the sector being close to a net position of zero before that). Doing that means we are left with:

Here we see that maybe the headline that our net external debt is zero may not be reflective of the underlying position but it has fallen by around €100 billion in the past four years and the €100 billion that remains is due to the government sector.

Of course, debts aren’t the only financial assets that make up a balance sheet. If we look at the overall net international investment positions of the various sectors of the economy we see the following:

This doesn’t change the position of the government sector much which has a net position of minus €100 billion as it has few non-debt foreign assets to offset its net external debt position. We do see that financial intermediaries have a net position of more than plus €100 billion. This are the non-domestic investment of pension and insurnance funds.

This means that we may be able to get back to zero after all. Here is the net international investment position for the economy (excluding the IFSC thuogh that has a small net position anyway). The chart also shows the net position excluding the NFC sector, the figures for which are dominated by MNCs and redomiciled PLCs – both of which are largely foreign-owned.

So our underlying net debt position still might have a bit to go to get to zero but our underlying net international investment position has got there. We could pay off all our foreign debts with our foreign assets (though I can’t see Irish pension funds putting all their assets into Irish government bonds). All in all the external position isn’t too bad but there still remains an overhang of domestic debt.

Tweet

No comments:

Post a Comment