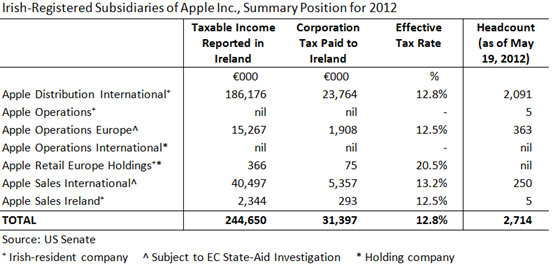

The following table gives a summary position for 2012 of Apple’s Irish-registered subsidiaries (click to enlarge).

In 2012 Apple had seven Irish-registered subsidiaries. Four of these are Irish-resident for tax purposes. The three non-Irish resident companies (AOE, AOI and ASI) were central to the 2013 US Senate Investigation into Apple when it was shown that these companies are not tax resident in any jurisdiction.

AOE and ASI carry out activities in Ireland through branches in Ireland and these branches are subject to a state-aid investigation by the European Commission. AOI is a holding company that has no physical manifestation outside the U.S.

Across all its operations, Apple’s reported taxable income in Ireland was €224.7 million. On this it paid €31.4 million of Corporation Tax giving an effective tax rate of 12.8 per cent. The taxable figure is primarily made up of trading profits which are subject to the 12.5 per cent rate but also includes passive income such as interest which are subject to Ireland 25 per cent Corporation Tax rate.

As of May 2012, these subsidiaries had 2,714 direct employees in Ireland. According to figures given to the US Senate these employees were 3.5 per cent of Apple’s total headcount (or 8.7 per cent of the head count excluding Apple retail store employees – Apple has no retail stores in Ireland). Apple estimated that it’s Irish employees received 2.1 per cent of total employee compensation in 2012.

The average amount of taxable income generated per Irish employee was €90,000. In the year to September 2012, Apple Inc had earnings before taxation of $55.8 billion. The taxable income reported in Ireland equates to around 0.6 per cent of Apple Inc.’s total pre-tax profits.

At the European Parliament TAXE2 Committee last week, Cathy Kearney gave the following update on Apple’s impact:

TweetIn Ireland we directly employ almost 5,500 people, an increase of 25 per cent in 2015. 93 per cent of our employees in Ireland are EU citizens and 44 per cent of those are non-Irish nationals. This is something we are extremely proud of.

Our overall operations in Ireland support a total of 18,000 jobs and last year we spent over €200 million with Irish companies.

Apple is now the largest private employer in Cork where we provide a variety of important functions including customer service, sales, finance and logistics. We continue to manufacture products in Cork which is only Apple-owned manufacturing facility in the world.

No comments:

Post a Comment