The interest rate charged on mortgages in Ireland has been getting a considerable airing recently, particularly the rate charge on loans on what is called the ‘Standard Variable Rate’. The following data from the Central Bank’s Money, Credit and Banking data shows the amount of PDH mortgages by the three main rate types:

- Standard Variable Rate

- Tracker Rate

- Fixed Rate

The total amount of loans at the end of 2014 was €90.6 billion. The separate mortgage arrears data from the Central Bank show that there was €104.9 billion of PDH mortgages in Q4 2014. The reason for the difference is coverage with the Credit, Money and Banking data only covering loans from banks currently trading in Ireland thus mortgages from Bank of Scotland (Ireland), INBS and other defunct entities are excluded. Still the above graph covers 86 per cent of PDH mortgages.

Over the four years for which the data is available (Q4 2010 to Q4 2014) the amount of tracker mortgages has fallen by €10 billion and now stands at €42.8 billion. If we apply the current rate of amortisation in a linear fashion is means it will take another 16 years for the banks to clear the tracker mortgages from their books.

The amount of SVR loans has generally increased over the period and is now €41.6 billion.

The amount of accounts with a fixed rate fell (as interest rates declined) in 2011 and 2012 but has recently started rising again – perhaps as those on SVRs switch to avail of lower fixed rates. In the chart fixed rate only refers to those fixed for more than one year. Loans which are fixed for up to one year are included in the SVR total as these essentially face the same conditions.

There was €2 billion of PDH mortgages fixed for up to one year (which itself was an increase of €0.5 billion over the year) and €6.1 billion of PDH mortgages fixed for more than one year (also showing an increase of €0.5 billion over the year).

What the aggregate data cannot show is the distribution of loan sizes. It is commonly stated that there are 300,000 households with SVR mortgages. This is half of the 600,000 households who have a mortgage. The average mortgage across all households with a mortgage is around €175,000 but there are lots of underlying factors that the average ignores.

If the average age of SVR loans is older than that of Trackers we could expect a greater proportion of small loans in the SVR category. This is because older loans will have been taken out when house prices were lower and the borrower will have had longer to repay the capital. Some insight into these characteristics would be useful.

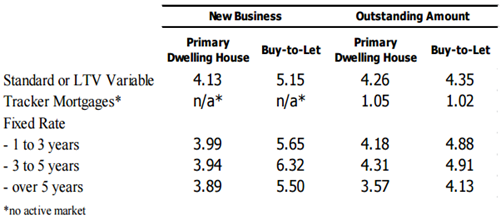

The average rates for new business and outstanding amounts are shown in the following table from the Central Bank.

Across all categories the “interest rates on outstanding loans for house purchase were broadly unchanged at 2.71 per cent at end-March 2015.”

If €41.6 billion of SVR mortgage holders face an interest rate that is one percentage point higher than would be charged in ‘normal’ times then the extra interest they are paying each year is around €400 million. If there are 300,000 households with an SVR mortgage that is average of €1,300 per household per year.

Tweet