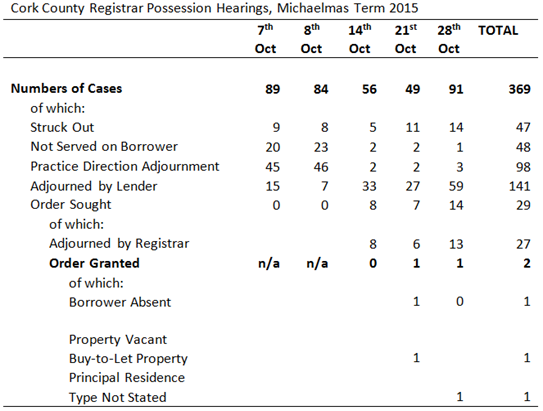

There were five hearings before the Cork County Registrar of civil possession cases in October. Across the five dates some 369 cases were listed and all bar two of these involved residential property (PPRs and BTLs). The outcomes are summarised below:

Compared to earlier sittings there are now more cases being struck out and this happened to 13 per cent of the cases listed in October. It is not always stated why a case is to be struck out but some of the reasons given are:

- the property has been sold or voluntarily surrendered and the legal proceedings are unnecessary.

- the person is back making full repayments on the mortgage

- there are legal issues that mean the proceedings must be withdrawn (some of these relate to the Finnegan judgement)

The most frequent outcome when cases come before the County Registrar is for them to be adjourned. In October, 98 cases were adjourned as per the practice direction of the President of the Circuit Court which requires that possession cases involving mortgages be adjourned on their first date before the court. Even more cases were adjourned by the lenders themselves with 141 cases adjourned by the applicant banks.

There are many reasons for this. Some are for legal reasons such as to change the name on the civil bill because the loan has been sold but most are because there is on-going engagement with the borrowers. The banks can seek time to assess a recently submitted SFS or they can seek time to see if the borrower can adhere to a revised repayment amount for a test period. Some cases are adjourned generally with no new date given but the applicant has “liberty to re-enter” if circumstances change, such as the borrower not adhering to an long-term repayment arrangement.

There were 48 cases listed which could not proceed because notice of the case had not been served on the borrower. This seems to be a combination of borrowers who cannot be found (thus substitute service such as ordinary post or pinning the notice to the property is required) and instances where the lender has issued a civil bill but not formally served notice on the borrower (possibly because some engagement is now taking place).

Cases where service cannot be effected will likely conclude with a possession order being granted (with many of these properties likely to be vacant) while cases were service has been delayed will hopefully be struck out at a future return date (if the borrower can resume payments to the satisfaction of the lender).

There were 27 cases where the lenders proceeded with their application for a possession order. They were granted two possession orders, of which one was by consent. In the 25 other cases where the lenders sought an order the case was adjourned against their wished. About half of these were back to future hearings of the County Registrar with the other half sent for hearing before a judge of the Circuit Court.

All the 91 cases that were on the list for the 28th of October are cases that had previously been heard before the County Registrar. Of these, 18 had been adjourned by the County Registrar in previous sittings where the lenders had sought to proceed with their application for a possession order.

When these cases came around again in October the lenders sought to proceed in just five of the cases while the other 13 were adjourned by the lenders as engagement, of some level, was now taking place. One case where the lender had previously sought an order for possession was adjourned generally by the lender with liberty to re-enter.

Of the five cases where the lender proceeded again with their application for possession four were adjourned by the County Registrar and in three of these this was the third time this year this happened. In one of these no payment had been made since 2009 and the arrears are over €120,000. A proposal for a lump-sum payment was made at a hearing back in July but has not yet materialised. The borrower had legal representation in court who said the lump-sum would be available in May 2016. The case was adjourned to February with the Registrar requesting that some regular payments be made in the interim.

One order was granted and that was by consent with the borrower present in court. For notes on this case from a hearing last July see case #10 on this list. Typically a stay of three to six months is applied to such orders but the borrower asked for a short stay as they were no longer using the property. It was set at one month.

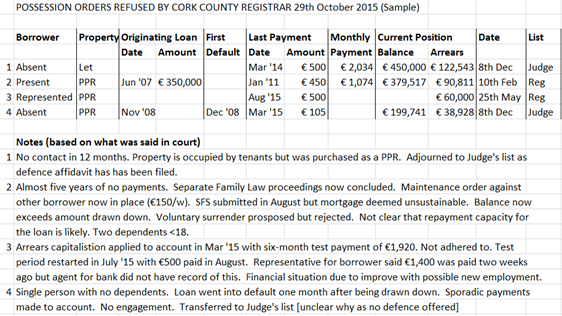

In this hearing there were nine cases where the lenders proceeded for the first time with their application for a possession order. All of these cases were adjourned. In five of them the borrower was present or represented in court and got an adjournment very quickly with very little information provided. There was more discussion of the other four and the details are summarised below (click to enlarge):

Of the total of 369 cases heard in October about 310 will appear on future lists for sittings of the County Registrar. And no doubt will accumulate fees for the legals involved.

Tweet

No comments:

Post a Comment