We now have five years of data on repossessions of primary dwelling houses (PDHs) from the mortgage arrears statistics published by the Financial Regulator. The figures here are taken from the quarterly releases.

In the five years from 2010 to 2014 there were 1,056 court-ordered repossessions and 2,598 PDHs that were voluntarily surrendered.

There has been a slow increase in the rate of court-ordered repossessions. The annual totals for the past five years are:

- 2010: 102

- 2011: 196

- 2012: 194

- 2013: 251

- 2014: 313

The trend line for court ordered repossessions shows a rise of about 2 per quarter.

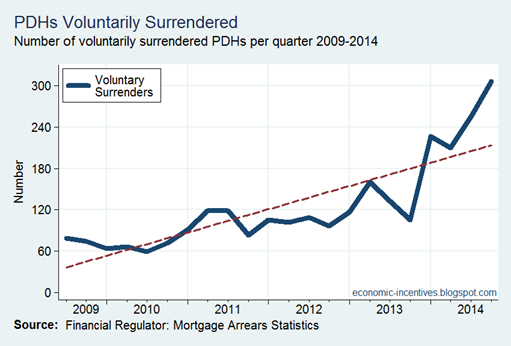

There has been a notable increase in the number of PDHs that were voluntary surrendered.

The annual total for the above series are:

- 2010: 261

- 2011: 412

- 2012: 412

- 2013: 515

- 2014: 998

Of PDHs that are repossessed 70 per cent are voluntarily surrendered and 30 per cent are on foot of a court order. There remains a lack of data on the number of forced sales where the bank does not take formal possession of the property but forces the sale in order to use the proceeds to offset the mortgage.

The second set of figures in the table below relate to the number of court proceedings for repossession issued by lenders. These jumped up considerable in Q3 2013 when the lacuna in the law known as the ‘Dunne Judgement’ was resolved.

Court proceedings issued “means that a formal application has been made to a Court to begin repossession proceedings during the quarter. Includes:

- cases where an application has been made to Court but a Court date has not yet been received;

- cases where Court proceedings have issued but have not been served.”

Court proceedings concluded “includes cases where an Order for Possession/Sale has been obtained or Court proceedings have concluded because:

- proceedings have been struck out;

- settlement agreement has been entered on the record;

- proceedings have been adjourned generally (i.e., proceedings may have been settled, but the settlement remains a matter of agreement between the parties, and does not form part of the Court record; the lender will be able to recommence proceedings if the borrower does not comply with the agreement);

- proceedings have been dismissed;

- judgement has been entered in favour of the lender, including an Order for Possession/Sale.

It excludes:

- cases where the value of the property has been realised but an amount remains outstanding on which the lender is seeking repayment.

- cases under appeal.”

It can be seen that around 47 per cent of concluded court proceedings result in the granting of a court order for repossessions. The other cases are concluded by other means which include the lender and the borrower reaching an agreement on a revised repayment schedule.

The number of court proceedings issued has soared in 2014. The annual figures since 2010 are:

- 2010: 838

- 2011: 568

- 2012: 1,327

- 2013: 3,846

- 2014: 11,425

As stated this is partly related to the Dunne Judgement but also to the Mortgage Arrears Resolution Targets (MART) set for the lenders which count court proceedings as a “sustainable solution” for long-term arrears cases. In the case of some non-cooperative borrowers this may be only option available to lenders. There are still many borrowers in arrears who have not completed a financial statement for their lender. It is likely that issuing court proceedings will see some non-cooperative borrowers begin to co-operate.

The number of repossession orders granted has increased but not yet to the same extent proceedings issued as cases work their way through the system. The annual figures for the granting of court orders are:

- 2010: 418

- 2011: 445

- 2012: 398

- 2013: 626

- 2014: 968

Some repossession orders are not followed through on if the parties can reach agreement after the order is granted while some are the formal conclusion to what would otherwise be a voluntary surrender except that the borrower has ceased to participate in the process.

There have been 2,855 court orders for repossession issued over the past five years and 1,114 court-ordered repossessions have been followed through on, giving a rate of 40 per cent.

Over the past five years 47 per cent of court proceedings concluded result in a court order for repossessions and 40 per cent of those (19 per cent of all proceedings concluded) results in a court-ordered repossession.

Given the scale of the mortgage crisis the number of forced repossessions remains remarkably low. It won’t around 1,000 for long and with the increase in court proceedings issued and the likely subsequent increase in court orders granted we will see whether this will translate into an increase in actual forced repossessions.

UPDATE: Post updated on 10/03 to reflect Q4 2014 figures.

Tweet

So nothing to do with house price movements then? I think comments that day it is related are of the mark. this is being used as a smokescreen for more poor and rushed proposed legislation.

ReplyDelete