The level of the ‘adjustment package’ in last week’s budget has created some confusion. The basic sum involves the €1.85 billion of new measures for 2014 announced last week, €0.65 billion of carryover effects (measures which were announced last year but kick-in this year) and €0.6 billion of “additional resources and savings”. So we have

€1.85bn + €0.65bn + €0.6bn = €3.1bn

The €0.6 billion of “savings” was not set out in the Budget documents but the Minister for Finance has subsequently confirmed it to be €0.2bn from the activities of the NTMA, €0.1bn extra on the Central Bank surplus, €0.15bn due to Live Register “fluctuations” (!), and another €0.15bn arising mainly from state asset transactions.

It is not clear why these items should be counted as adjustments, measures or savings. It is hard to see how policy changes have impacted them and most are things that would, or should, happen regardless of what was in the Budget.

The new measures in the budget were €0.35bn of net tax measures and €1.5bn of expenditure measures. There was around €0.65bn of new taxes introduced but some of this was offset by the retention of the special 9% VAT for tourism etc. which cost around €0.3bn. The tax measures are summarised in Table 7 of the Economic and Fiscal Outlook.

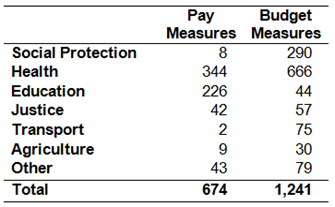

A summary of the €1.5bn of expenditure measures (€1.4bn current and €0.1bn capital) is not provided but it can be quickly extracted from the Expenditure Allocations report. There are two current expenditure measures we can look at:

- Central Policy Developments: Pay policy measures

- Savings measures introduced in 2014 to adhere to the ceiling

The first are the savings that arise from the Haddington Road Agreement brokered between the government and the public sector unions earlier this year and the second are the measures announced in the Budget. All comprise the adjustment made to current expenditure for 2014 and are summarised here (in €million).

The total of €1.9bn might suggest that there was over-achievement on the expenditure contributions but some of the savings here were used to loosen the pressure elsewhere. In last year’s budget a ceiling of €49.2bn was set for gross voted current expenditure in 2014. As a result of decisions taken the ceiling was increased to €49.6bn. This means some of the savings above were used to fund expenditure elsewhere bringing the net expenditure adjustment to €1.5bn.

For example, Education shows €226 million of pay savings for 2014 but the Department’s pay bill in the Estimates shows a fall of €184 million. The difference is explained by additional staff (mainly teachers and teaching assistants). Staff numbers under the remit of the Department of Education will rise from 94,490 this year to 95,745 in 2014 – an increase of nearly 1,300. Capital expenditure on education is also set to increase by around €135 million in 2014 – a rise €65 million greater than what was budgeted for last year.

So now it seems we are left with the following budgetary sum.

Whatever about their precise nature the €0.6bn of “additional resources and savings” are needed to bring the sum to three point one.

Tweet

No comments:

Post a Comment