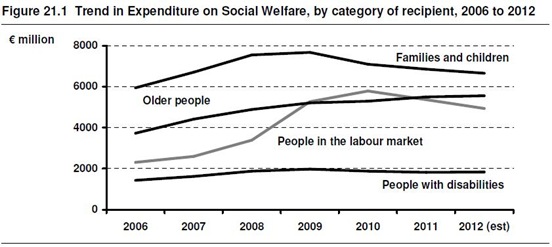

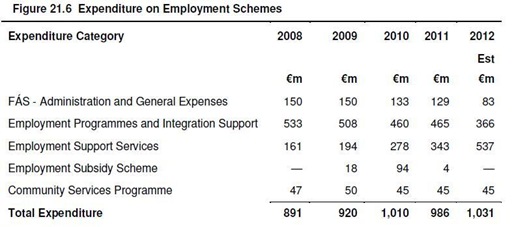

Chapter 21 of the 2011 Comptroller and Auditor General’s Account of Public Services includes the following chart on trends in welfare expenditure.

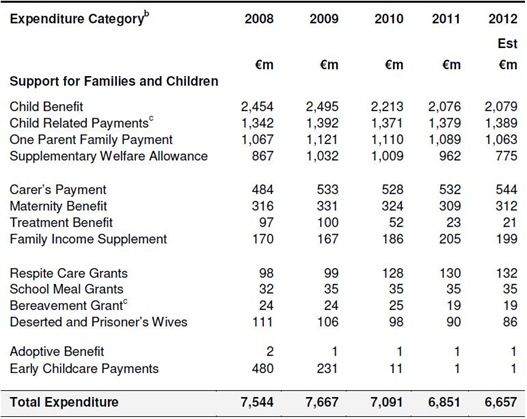

The figures since 2008 used in the above table are in the first section of this table.

The 2012 figure is an estimated based on voted allocations at the time of the report (Sep 2012). Since then there has been a supplementary estimate for the Department of Social Protection of €685 million, of which €264 million was due to more than anticipated expenditure on Jobseeker’s Allowance. Thus the 2012 total for support for ‘people in the labour market’ will be around €5,200 million and the overall total for the table close to €21,000 million, with little overall change from 2011.

The trends in the chart are easily identifiable. There have been falls in the aggregate financial support provided to ‘families and children’ and to ‘people in the labour market’. Support for ‘people with disabilities’ fell in 2010 and 2011 but is due to rise very slightly in 2012. Support for ‘older people’ continues to rise year-on-year with a rise of around €1 billion since 2007. A more detailed breakdown of the expenditure under each category is in tables below the fold at the end of the post.

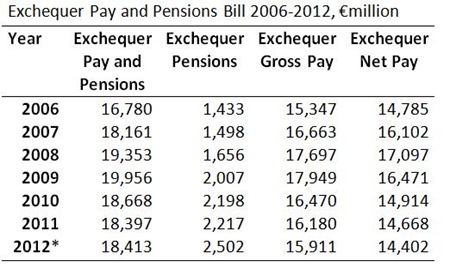

Here is a table taken from the Analysis of the Exchequer Pay and Pensions Bill published by the Department of Public Expenditure and Reform.

It can be seen that the gross Exchequer pay and pensions bill is forecast to rise in 2012, though only by €16 million or 0.09%. The subsequent column show the breakdown of this. The Exchequer pensions bill will rise by €285 million, while the gross pay bill will fall by €269 million.

The Exchequer net pay bill is the gross bill less employee pension contributions in the civil service, health, education, guards and army of €536 million which are used to fund other expenditure and the employee deductions for the public sector pension levy of €930 million across all departments which are also used to fund other expenditure. Some other minor employee contributions bring the total to €1,509 million. In essence, this is money that forms part of the gross pay bill but is deducted.

The Exchequer net pay bill is expected to fall by €266 million this year to €14,402 million. PRSI, Income Tax and the USC will be further collected on this to reflect the net pay measure from the employee’s perspective.

The fall in the pay bill in 2012 (both gross and net) was more than offset by the rise in the pensions bill which has risen €1 billion since 2007.

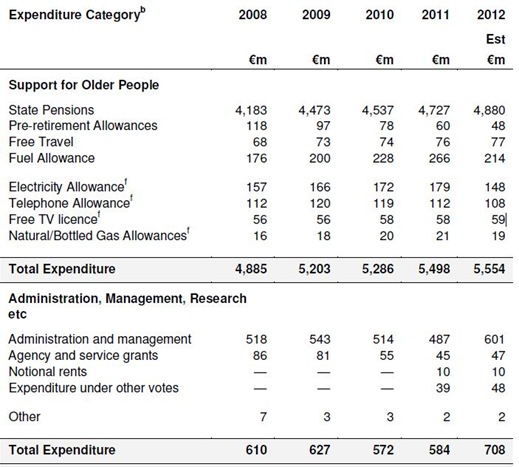

Since 2007, the social welfare bill for state pensions and the exchequer pensions bill has risen by around €2 billion. Many of the reductions in current expenditure elsewhere are being consumed by increases here.

Of course, this is mainly because of demographic factors rather than policy changes. The number of people aged 65 and over increases by around 20,000 per annum as entrants to this category is greater than the death rate, while the number of public sector pensioners is rising by around 8,000 per annum.

Tweet

Note that PS pay was effectively cut twice, with a cut to gross pay and the PRD pension levy. However, PS pensions were not cut, though they are subject to a (small) PRD.

ReplyDeleteSo a retired teacher on a gross pension of 700 pw suffers one cut, existing teachers take two cuts, while new entrants suffer FOUR cuts to pay!!

Where is the solidarity?

I feel existing PS pensions should be cut more.