The number is out. The banks require another €24 billion of recapitalisation but we may not need to borrow a cent of it.

In a previous post we examined that debt sustainability of the State taking on additional banking-related debt if the bank recapitalisations required the full €35 billion set aside under the “worst case” scenario in the EU/IMF deal. The conclusion was:

Let’s assume that the “adverse scenario” of the stress tests matches the “worst case” scenario of the EU/IMF deal. This means a further €35 billion going to the banks, bringing the total cost of the bank bailout up to €81 billion. Adding the additional €17.5 billion of borrowings that this requires to the existing €35.6 billion of borrowings used for the banks so far means that we will have a €53 billion millstone of bank-related debt weighing us down (as well as the elimination of €20 billion of sovereign savings and the reduction of €7.5 billion in our cash balances).

This €53 billion of debt is sustainable (with sustainable being defined as the ability to avoid default). We could carry this debt and service the interest. It is hard to see how we can actually pay it off but having it is unlikely to tip us into default.

We now know that four of the six banks require an additional €24 billion in recapitalisation funds so this reduction of €11 billion will make the sustainability of this debt even more likely. But we also learned a few more things.

Irish Life and Permanent requires €4 billion. According to a statement issued by the company €1.1 billion of this will come from the sale of Irish Life with another €0.6 billion coming from existing company resources. The State will make up the €2.3 billion shortfall, but will not need to cover the entire €4 billion.

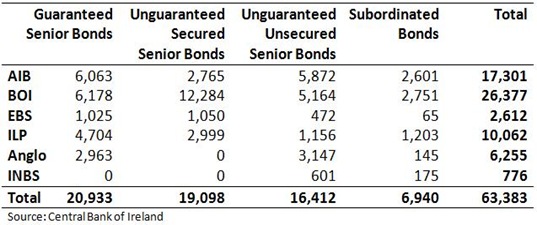

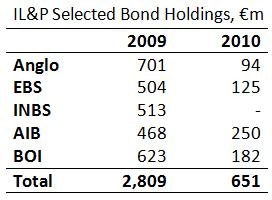

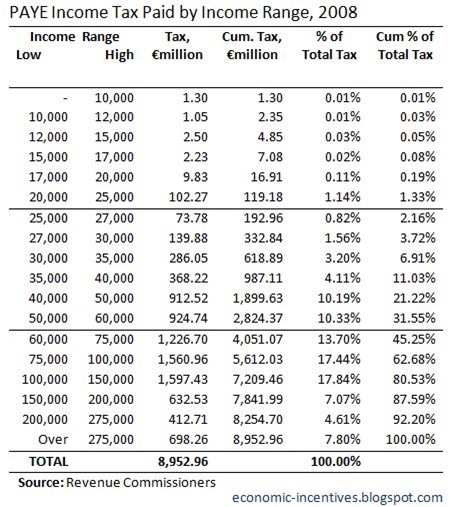

In an interview on RTE’s Six One News, the Minister for Finance, Michael Noonan indicated that part of the cost would be carried by subordinated debt holders. We looked the numbers in a previous post. Here is the table again.

The issue of burden sharing is raised 2:50 into the clip that features the Noonan interview on this page.

Per the ECB the first two columns cannot be touched. Noonan was questioned on the €16 billion of unguaranteed unsecured senior bonds but said there would be no burden sharing here either. (Though he did suggest this may be returned to in the case of Anglo and INBS may more details of their wind downs are revealed in May). Anyway, when discussing the subordinated bonds in all the banks he said:

“We can burden share in subordinated bonds and that will give us between five and six billion of the €24 billion.

Six billion is probably a slight exaggeration but a 70% haircut would knock €4.9 billion off the banks’ liabilities and is achievable.

We already knew that €10 billion of the funds would come from the further destruction of the NPRF. Also, as part of the EU/IMF deal the State was going to have to provide an additional €7.5 billion from the existing €15 billion of cash balances held by the NTMA.

So all told, to get this €24 billion.

- €1.9 billion will come from the existing assets of Irish Life & Permanent

- €4.9 billion will come from burden sharing with subordinated bond holders

- €10 billion will come from the National Pension Reserve Fund

- with the final €7.2 billion coming from existing cash reserves.

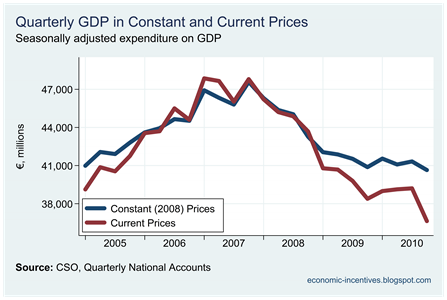

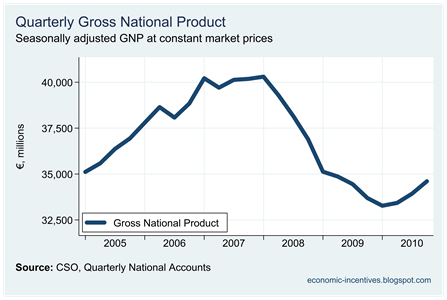

This phase of the recapitalisation could be financed without any recourse to additional borrowing. The debt that has been created by the earlier rounds of the recapitalisation process is €35.6 billion. This process is a colossal waste of money but this is a debt burden that a country with a GDP of €153.9 billion can carry. As before, default is an option not an inevitability. The important things now are to draw a line under this banking fiasco and to get the public deficit under control. There is still some doubt about our ability to attain either.

Tweet