Earlier in the week we looked at the numbers relating to bonds issued by the six covered banks from the Central Banks’ Money, Credit and Banking Statistics. This was a useful analysis, up to a point. We now have a much better set of numbers released by the Central Bank that gives a detailed breakdown of the bonds issued by the covered banks.

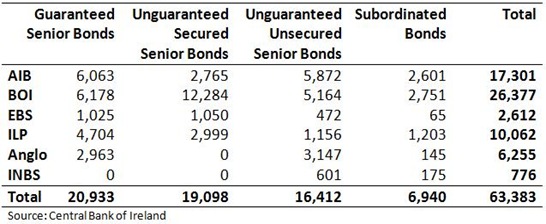

The original release is here and the key table is reproduced here with an additional total column providing totals for the individual banks.

The numbers are fairly self explanatory and we can see that there are €63.4 billion of bonds in issue. The balance sheet data from Table 4.2 of the Money, Credit and Banking Statistics that were explored in the post linked above indicated that there were €79.1 billion of bonds issued by these banks. The apparent discrepancy can likely be accounted for by again noting that the banks issued about €17 billion of bonds to themselves in January. So that still leaves us with the question of who holds these €63.4 billion of bonds.

When the December figures were released we looked at the ownership of these bonds and concluded that “the proportion of bond held by Irish residents has been rising since the guarantee was introduced and now stands at just over 50%”. This was for all domestic Irish banks. Since then we have got a breakdown for the six covered banks and the original conclusion remains unchanged.

Of course, what we could not say was who actually holds these bonds. That did not stop some to extend the analysis beyond what it could really do – see 22 minutes into this clip where it was suggested that “half of these bonds are held by Irish credit unions and Irish pension funds”. It is still true that more than half of the bonds are held by Irish residents, but it could be holding companies of foreign banks that are simply domiciled in Ireland, most probably in the IFSC. This suggestion was made elsewhere – see 47.5 minutes into this clip.

Can we cast any light on this issue? Maybe.

Again using the Central Bank’s data on the banks’ balance sheets we see that on the asset side the six covered banks hold €31.8 billion on bonds issued by Irish financial institutions. Now it could be that these are bonds issued by non-covered banks or banks in the IFSC. If we look on the liability side we see that all banks operating in Ireland have issued €50.8 billion of bonds that are held by Irish residents. Irish banks hold €31.8 billion of this (which includes the €17 billion of self-issued bonds). Of the €50.8 billion of bonds in issue from Irish banks held by Irish residents, €50.2 billion has been issued by the six covered banks.

The implication of this should be fairly clear. Of the €63.3 billion of bonds in the covered banks shown in the above table, something in the region of €15 billion is held by the covered banks themselves. As the €17 billion of self-issued bonds in January was excluded from this table it is likely that this €15 billion are bonds the banks hold in each other.

Finally, we can see that all banks operating in Ireland (covered, domestic and IFSC) hold €33.3 billion of bonds issued by Irish financial institutions (which is 99% from the covered six). Domestic or retail banks hold €31.8 billion of these bonds. This means that IFSC banks only hold €1.5 billion of bonds in the covered banks.

What do we conclude?

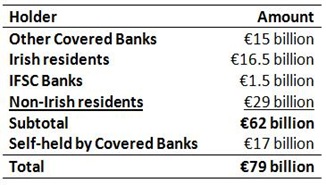

The covered six have €79 billion of bonds issued. About €17 billion of these are guaranteed self-issued bonds which are being used as collateral with the ECB. Another €15 billion are held by the covered banks themselves. Banks in the IFSC hold only €1.5 billion of these bonds. That accounts for €33.5 billion of the €50 billion of covered bank bonds held by Irish residents.

Who holds the other €16.5 billion? It could be “Irish credit unions and Irish pension funds”. It could be IFSC-based non-banking institutions that do not appear in the Central Bank statistics. We don’t know. We do know that non-Irish residents hold €29 billion of bonds issued by the covered banks. So we get the following table for the €79 billion of bonds in issue.

If the bondholders do get “burned” there will be yet another hole in the balance sheets of the nationalised and part-nationalised banks and they will need to be further recapitalised. (Guess who?) That leaves about €48 billion of bonds, with some unknown quantity up to a maximum of €16.5 billion Irish held, but at least €31.5 billion held by non-Irish investors.

It would be great if we had a breakdown of the holdings outlined here by the four categories used in the table at the top. €40 billion of the bonds are either guaranteed by the State (€21 billion) or secured against collateral like mortgages (€19 billion). That leaves €23.5 billion in play. We could really do with knowing who holds these bonds. It could be the banks themselves!

There probably is some scope for burden-sharing but maybe not as much as first thought and for substantial savings to be made attention will have to turn to the guaranteed and secured bonds. There definitely is not as much to be saved as in August 2008 (the month before the blanket guarantee) when non-Irish residents held €82 billion of bonds issued by the covered banks.

Tweet

No comments:

Post a Comment